Get the free idaho form 75

Show details

Includes Biodiesel and Biodiesel Blends Rate change for Av Gas and Jet Fuel effective July 1 2008. Instructions for Idaho Form 75 Use this form for fuel purchased on or after July 1 2008. See instructions. Authorized signature Date Title Paid preparer s signature Daytime phone Preparer s EIN SSN or PTIN Address and phone number Call 334-7660 in the Boise area or 800 972-7660 toll free. MAIL TO Idaho State Tax Commission PO Box 76 Boise ID 83707-0...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your idaho form 75 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your idaho form 75 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit idaho form 75 online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit idaho form 75 pdf filable. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

How to fill out idaho form 75

How to fill out Idaho form 75:

01

Gather all the required information and documents such as your personal details, income information, and any supporting documentation.

02

Carefully read the instructions on the form to understand the requirements and procedures for filling it out.

03

Start by entering your personal information, including your full legal name, address, and contact details.

04

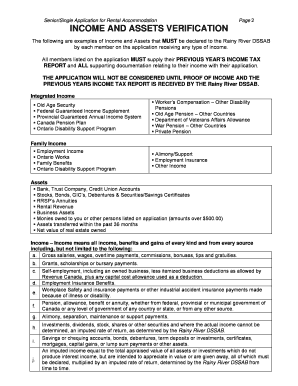

Provide any required financial information, such as your income, assets, and liabilities. Make sure to provide accurate and up-to-date information.

05

If there are any specific sections that require additional information or documentation, ensure to provide them as instructed.

06

Double-check your entries for any errors or missing information before proceeding.

07

Sign and date the form, as required.

08

Make copies of the completed form for your records, if necessary.

09

Submit the form to the appropriate authority or organization, following any specific instructions provided.

Who needs Idaho form 75:

01

Individuals who are required to report their personal and financial information to the relevant authorities in Idaho.

02

Residents of Idaho who need to apply for certain benefits or programs that require the completion of form 75.

03

Any person or entity as specified by the Idaho state regulations that mandates the use of form 75 for a particular purpose.

Fill form : Try Risk Free

People Also Ask about idaho form 75

What is Idaho form 75 for?

Do you file state taxes in Idaho?

Who has to pay Idaho state taxes?

How do I get my Idaho tax rebate?

Is Idaho sending out relief checks?

Who is required to file Idaho state tax return?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

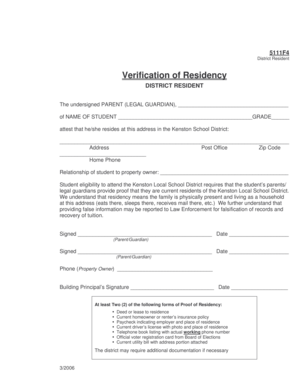

Who is required to file idaho form 75?

Idaho Form 75 is the Idaho Individual Income Tax Declaration for Electronic Filing, and it is required to be filed by individuals who are filing their Idaho state income tax return electronically.

What is the purpose of idaho form 75?

Idaho Form 75, also known as the "Idaho Sales Tax Exemption Certificate," is used for the purpose of claiming exemption from paying sales tax on certain products or services in the state of Idaho. This form is typically filled out by individuals or entities who qualify for specific sales tax exemptions, such as nonprofit organizations, government agencies, or businesses engaged in manufacturing or wholesale activities. By submitting Form 75 to a seller or vendor, the purchaser can provide proof of their exemption status and avoid paying sales tax on eligible transactions.

What information must be reported on idaho form 75?

Form 75 is used for reporting annual information regarding wages and income taxes withheld from employees in the state of Idaho. The following information must be reported on Idaho Form 75:

1. Employer's name, address, and federal employer identification number (FEIN)

2. Number of employees receiving wages during the year

3. Total taxable wages paid to employees during the year

4. Total Idaho income tax withheld from employees' wages

5. Total Idaho income tax deposited with the Idaho State Tax Commission

6. Total wages subject to Idaho unemployment insurance tax

7. Total Idaho unemployment insurance tax paid

8. Any other required information or attachments as specified by the Idaho State Tax Commission.

It is important to carefully review the instructions provided with the form to ensure all necessary information is accurately reported.

When is the deadline to file idaho form 75 in 2023?

The deadline to file Idaho Form 75 in 2023 is not available as it depends on the specific tax year. The Idaho state tax agency typically releases the filing deadline for the subsequent tax year in early January. Therefore, it is recommended to check the official Idaho State Tax Commission website or consult with a tax professional for the most accurate and up-to-date information regarding the deadline for filing Idaho Form 75 in 2023.

What is the penalty for the late filing of idaho form 75?

The penalty for late filing of Idaho Form 75, also known as the Idaho Sales and Use Tax Return, is calculated as a percentage of the tax due on the return. The penalty for late filing is 5% of the tax due for the first month, and an additional 5% for each month thereafter, up to a maximum of 25%. Additionally, interest is charged on any unpaid tax at a rate of 0.5% per month or fraction of a month.

How can I manage my idaho form 75 directly from Gmail?

idaho form 75 pdf filable and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

Can I edit form 75 on an iOS device?

You certainly can. You can quickly edit, distribute, and sign where to mail iho form 75 on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

How can I fill out fillable idaho form 75 on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your idaho form 75 ic. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

Fill out your idaho form 75 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 75 is not the form you're looking for?Search for another form here.

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.